instacart tax form canada

Instacart contracts Checkr Inc to perform all Shopper background checks. As you can see in the example above this Instacart batch is a total of 42 miles so you know approximately how far you.

Boost Your Courier Delivery Business Sales By Investing In A Courier Service App Services Business Courier Service Business Courier Service

The 1099-NEC is a new name for the 1099-MISC.

. There will be a clear indication of the delivery fee when you are choosing your delivery window. Instacart welcomes you just as you are-we celebrate your unique paths and experiences that have brought you to our table. Read about our approach to Diversity Equity Belonging.

If you are employed by Instacart a W-2 will be sent by January 31st. While Stride operates separately from Instacart I can tell you that Instacart will only prepare a 1099-NEC for you if. Instacart delivery starts at 399 for same-day orders 35 or more.

Instacart must deliver your 1099 to the IRS by January 31st each year. No matter what you bring to the potluck theres a seat at the table for you. When Instacart extended a conditional offer to you to provide services on the Instacart platform we obtained authorization from you to perform a background check.

You will also find information on where to report it on your income tax and benefit return. As always Instacart Express members get free delivery on orders 35 or more per retailer. Fees vary for one-hour deliveries club store deliveries and deliveries under 35.

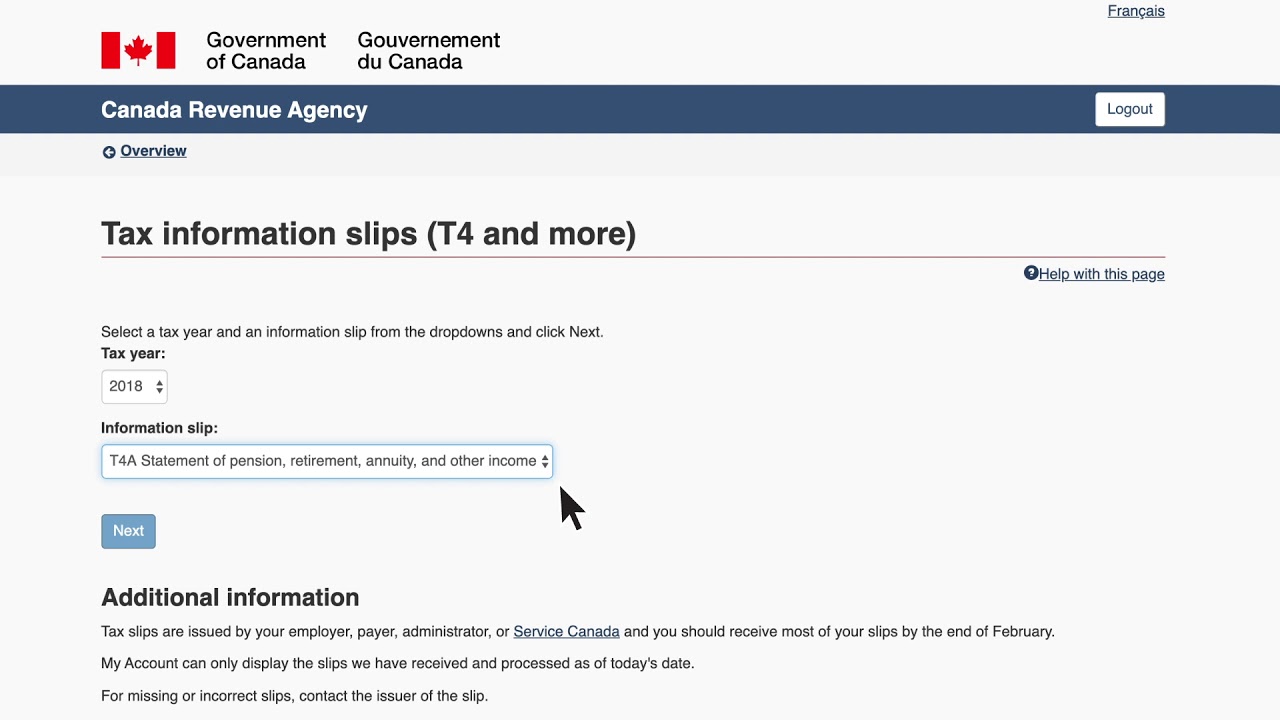

When youre ready tap Next. Find information about what you have to report as income. Tracking your order and delivery.

For a flat annual cost or a. Sent to full or part-time employees. Quebec residents have to apply for GSTHST and QST numbers.

Visit this TurboTax link for more information on tax deductions for the self-employed. In Canada we usually get a tax form called a t4 from the employer which can be used to file the taxes. Instacart Tax Forms.

It shows your total earnings plus how much of your owed tax has. What tax forms do Instacart shoppers get. For SE self employment tax - if you have a net profit after expenses of 400 or more you will pay 153 for 2017 SE Tax on 9235 of your net.

If you earned at least 600 delivery groceries over the course of the year including base pay and tips from customers you can expect this form by January 31. Tax tips for Instacart Shoppers. Posted by 2 years ago.

Download the Instacart app or start shopping online now with Instacart to get groceries alcohol home essentials and more delivered to you in as fast as 1 hour or select curbside pickup from your favorite local stores. If you have other business activities that are registered under a different business number you file a separate T2125 form for it. In Canada we usually get a tax form called a t4 from the employer which can be used to file the taxes.

I got one from Uber since I also work for them part time and its super simple and easy. Knowing how much to pay is just the first step. Confirm once you confirm youre registered for GSTHST.

All companies including Instacart are only required to provide this form if they paid you 600 or more in a given tax year. Background check processing time. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers.

In Canada we usually get a tax form called a t4 from the employer which can be used to file the taxes. According to Instacart if you dont meet this requirement you wont receive a 1099-NEC. Learn the basic of filing your taxes as an independent contractor.

In the menu select Tax identification. He should use the industry code for Instacart in his T2125 form. You dont need a membership to shop with Instacart.

What tax forms do Instacart shoppers get. Independent contractors who earn more than 600 a year will get an Instacart 1099-NEC. Hi folks I joined instacart in February 2018 and this is my first full year with instacart which means its time to do my taxes.

Fortunately you can still file your taxes without it and regardless of whether or not you receive a. However you can look through all of your completed batches and see how many miles you drive for Instacart in total. However Instacart Express is a membership option for customers who want to save more and get other exclusive benefits.

Your earnings exceed 600 in a year. Filing taxes in canada. Currently the Instacart Shopper app doesnt track the miles you drive in a single easily readable form.

Your earnings exceed 600 in a year. You wont send this form in with your tax return but you will use it to figure out how much business income to report on your Schedule C. The Instacart 1099 tax forms youll need to file.

Background checks normally process within 10 business days. To actually file your Instacart taxes youll need the right tax form. In the Instacart Shopper app tap the Account icon in the bottom right corner.

Guide To Filing Tax Returns For Delivery Drivers In 2022 Indeed if your earnings in Instacart is above 600 per tax year you will receive a 1099-MISC tax form. Instacart on the other hand isnt so simple I.

Tax Tips For Couriers On The Skip Network Youtube

How To Get Brandy Melville Orders Shipped To Canada Apr 2022 Yore Oyster

Instacart Driver Jobs In Canada What You Need To Know To Get Started

براءة إختاع جديدة من Dell قد تعني تطوير لاب توب بشاشة قابلة للطي Corporate Strategy Best Android Phone Computer Technology

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Intuit Turbotax Standard 2021 8 Returns English Digital Download Costco

Intuit Turbotax Premier 2021 12 Returns English Digital Download Costco

Updated Kar To Sell Adesa Us Physical Auction Business To Carvana For 2 2b In 2022 Physics Things To Sell Business

Instacart Driver Jobs In Canada What You Need To Know To Get Started

What Is A Gst Hst Number Canada Only Instacart Onboarding

Instacart Driver Jobs In Canada What You Need To Know To Get Started

Turbotax Canada Uber Partner Webinar For The 2017 Tax Year Youtube

How To Get A Copy Of Your T4 Slip Turbotax Canada 2020 Youtube

How To Register For Gst Hst In Canada For Your Small Business Youtube

Instacart Driver Jobs In Canada What You Need To Know To Get Started